Keep Reading

3 Steps to Overcome the Fear of Spending Money

Updated June 18, 2024 | Originally published March 12, 2019 As part of our Two-Cents Tuesday series. It’s Two-Cents Tuesday Episode 11! Each every other week I’ll be answering audience submitted questions over on my YouTube Channel! Today’s question comes from Suz. She asks : “I have so much trouble biting the bullet for big purchases. […]

Paragraph

Updated June 18, 2024 | Originally published March 12, 2019

As part of our Two-Cents Tuesday series.

It’s Two-Cents Tuesday Episode 11! Each every other week I’ll be answering audience submitted questions over on my YouTube Channel!

Today’s question comes from Suz. She asks :

“I have so much trouble biting the bullet for big purchases. Vacations, technology, art, shoes. It always seems irresponsible because if it’s not something I absolutely need, then I just shouldn’t get it.

On the one hand, that is good because I would hate to be able to make big purchases without blinking an eye.

However, I have no problem spending $10-20 on small dumb things that I don’t need like eating out, coffee shop pastries, etc. and all of those things are eating away at my budget just as badly as the big purchases I would have— except I don’t even have the joy of the bigger purchases!

What is wrong with me? What do I do to change this setting in my brain? (Mama needs a vacation.)”

Suz! You’re cracking me up lady. I am so glad you submitted this question as I think fear of spending money is a common struggle. Here’s my two-cents ⬇️

3 Steps to Overcome the Fear of Spending Money

Gosh I’m so pumped to answer this question today! First of all – there is nothing wrong with you!

In fact, asking this question (I believe) is a sign you’re already on the right track! How to change your brain—well, I could take that question in so many directions: money mindsets, creating habit change, behavioral finance, etc … so I decided to tell you a story instead!

I didn’t grow up with a lot of money. Of course, I didn’t know it at the time, but looking back as an adult I’m pretty amazed at the life my parents were able to provide on their income. I wore a lot of hand-me-down clothes, we shopped at the grocery outlet, and I only remember two family vacations ever. For birthdays we got to choose what we had for dinner … I honestly don’t remember a birthday party until I turned 18 and my friends threw that for me.

But the amazing thing was this … I didn’t know any different. I didn’t feel like a deprived child.

In fact, I felt the opposite. I was thankful for the things I had and never truly felt “want”. I am thankful for what my parents taught me.

But as my income increased and moved into adulthood, I found myself in a similar situation as what you described Suz… I would wear my clothes until they were threadbare and a $100 pair of jeans was unthinkable to me. Then I was introduced to the capsule wardrobe and I really wanted to try it. I had never really been “into” clothes, but as I got closer to my 30’s I thought it was high time I upped my clothes game (and working for a fashion designer didn’t help!).

MY AHA MOMENT

If you’ve ever created a capsule wardrobe, the first step is to take all your clothes out of your closet. As I cleaned out my jeans drawer my “aha moment” happened.

I had 8 pairs of $20-30 jeans that never fit “quite” right. If I had used that same $$ I could have purchased 1-2 pairs of those $100 jeans that actually fit me right and that I felt great in. Lightbulb moment 💡

Suz, It sounds like you had your own lightbulb moment when it comes to your spending. $20 at one time is easier than spending $100 at one time.

Sometimes we confuse quantity (the ability to purchase more items) with quality (fewer things, but of higher value). But it doesn’t take long for those little $20 purchases here and there to add up.

The people I see able to afford the things they truly dream of having are the ones who create intentional plans for their spending.

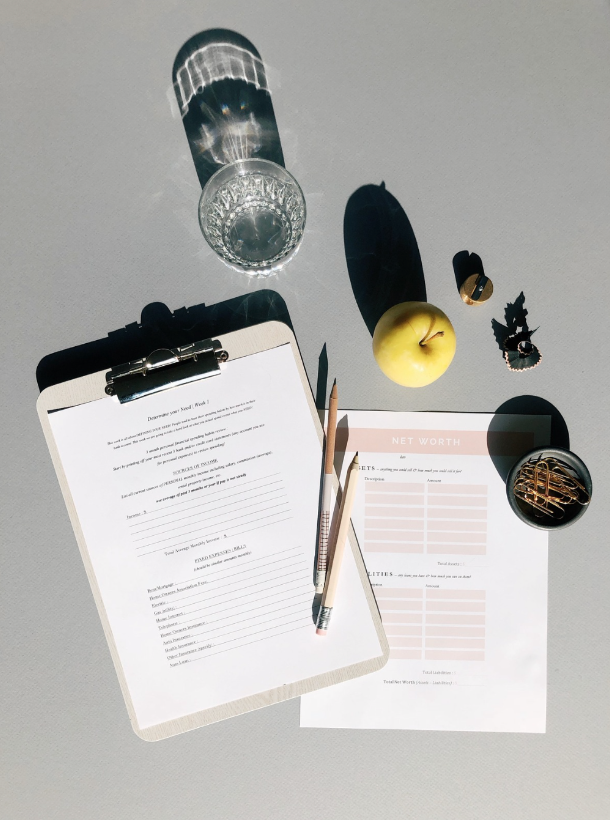

1. Look at where your money is going

I recommend printing off three months of bank statements, sitting down with multi-colored highlighters and categorizing your spending :

- Eating out

- Shopping

- Groceries

- Fuel

- Home Stuff

- Etc.

Where did your money go? Then, ask this key follow-up question: “is that where I WANT my money to go?” Seeing where you actually spend your money can help ease the fear of spending money in the future.

2. Start a dream list

What are some things you’d love to do or buy that take money? Money you’ve maybe never thought you’d been able to afford? (like that vacation or $100 pair of jeans!)

To some making a dream list (I call this your dream boat document) may seem silly – but actually, it’s an exercise in dreaming bigger. Often we just live day-to-day and moment-to-moment without mapping out these long-term dreams.

When we map out the plan it becomes pretty amazing to see some of those big dreams are actually possible! Getting clear on your dreams can help overcome the fear of spending money by knowing which purchases will help you reach your goals.

3. Flex your money muscles

Ok, I’ve been working out with a personal trainer lately so I have exercise on my mind, but it’s true! To get stronger in our weaknesses, we must flex a new muscle.

For Suz (and for probably a lot of us), limiting those mindless “small” purchases in exchange for intentional spending to save for bigger purchases is a muscle we need to flex and a habit we need to strengthen!

In order to do that—give yourself a limit to your weekly spending and instead vouch to save for something big this next month! Saving AND SPENDING are both muscles we have to flex. One may come more easily but it’s important to practice doing both well.

Interested to know exactly how I manage our home finances month by month? Meet Blueprint at Home!

Wealth isn’t about how much money you make, it’s about how you spend the money you make.

I could share SO much more about overcoming the fear of spending money and learning how to spend (and save!) your money for what you truly want. Which is why I put together this FREE masterclass “Budgeting for People Who Hate Budgets” ⬇️

⚠️ Warning: this will likely be the most FUN budgeting class you will ever attend! ⚠️

CLICK HERE TO REGISTER FOR FREE!

KEEP READING:

Do You *Really* Need a Budget? A Former Financial Advisor Weighs

Get Out of Debt – Our Journey to Financial Freedom

How to Manage Small Business Finances

NEED HELP GETTING YOUR FINANCES IN SHAPE?

SHARE THIS:

June 18, 2024

Previous Post:

Next Post:

And if you found this helpful, share with your friends!